China is winning the tech race against the US in almost all sectors and leaving Europe far behind. Saying this would have been controversial only a few short months ago, but such a realization is now becoming more mainstream.

Jim Farley, the CEO of US car giant Ford, warned last month: ‘They have enough [production] capacity in China with existing factories to serve the entire North American market, put us all out of business. Japan never had that, so this is a completely different level of risk for our industry.’

And Jensen Huang, CEO of the world’s most valuable company, Nvidia, had a similar take: ‘China is going to win the AI race.’

The risk to some of the largest corporations in the West is stark. As Chinese companies ascend to the cutting edge of global tech, often offering products at sharp discounts to those of Western competitors, disruptive shocks have started to hit some of the West’s largest and most famous corporations.

Disruption events come in different forms. Some are preceded by CEO warnings over Chinese competition. These may be followed by the ceding of market share to Chinese competitors either in China itself or in markets overseas. Later, evidence of disruption may come with lowered earnings’ forecasts and the issuance of guidance to shareholders.

There is no doubt that Chinese companies are making rapid strides in technological upgrading, often through innovation. Research from the Australian Strategic Policy Institute (ASPI) shows that China leads the US in 57 out of 64 critical technology categories. In the period between 2003-2007, ASPI found that China led in just three of the 64 technologies assessed.

Examples from three key industries – pharmaceuticals, electric vehicles and wind power – among many others highlight the impact of China’s disruptive shocks. If Western corporations are to weather these shocks, they need to self-strengthen and adapt with various strategies, supported by meaningful government-led industrial policy.

Pharmaceuticals

The challenges faced by Merck and Co, a large US pharmaceutical company, reveal the disruptive power of emerging Chinese pharma companies. Merck’s share price plunged on a few occasions in 2024 and early 2025 due to the declining sales of a popular HPV vaccine, Gardasil, in China.

The stress the company felt was partly due to the emergence of a Chinese competitor drug, Cecolin 9, developed by Xiamen Innovax Biotech. The price of Cecolin 9 was set at a 60 per cent discount to that of Merck’s Gardasil.

On February 4 this year, Merck shares tumbled 11 per cent in early trade after the company announced it would temporarily halt shipments of Gardasil to China. While Merck said it remained confident in Gardasil’s future sales prospects in China overall, it withdrew its long-term $11bn sales target for the vaccine.

Another potential disruption to Merck’s business comes from Akeso, a Chinese biotech company that beat Merck’s Keytruda, a multibillion dollar blockbuster cancer drug, in a head-to-head trial. Akeso won approvals in China for its new drug, ivonescimab, which is now on sale in the country.

China’s position as a global leader in pharmaceutical R&D is demonstrated by a series of announcements by European companies to boost their research presence in China. UK-based AstraZeneca pledged this year to build a $2.5bn R&D hub in Beijing. Novo Nordisk, the Denmark-based company, and Roche Group, the Swiss giant, have also announced large expansion plans in China.

Electric and hybrid vehicles

China’s march into electric and hybrid vehicle markets around the world is the most commonly cited example of its disruptive technological power. In September this year, Chinese car companies captured a record 7.4 per cent of all passenger car sales across Europe, up from 3.9 per cent at the start of the year.

Some Chinese car companies posted bumper increases in Europe sales. BYD registered a 304 per cent increase in year-on-year sales in the first nine months of this year, while Chery notched up an 862 per cent rise and Leapmotor, which makes ultra-affordable cars, posted a 7,108 per cent increase.

Carlos Tavares, former CEO of Stellantis, warned last month that as Western carmakers stumble, Chinese competitors will be ready to snap them up. ‘The day a Western carmaker is in severe difficulty, with factories on the verge of closing and demonstrations in the street, a Chinese carmaker will come and say ‘I’ll take it and keep the jobs’, and they’ll be considered saviours,’ Tavares said.

The share prices of VW, Mercedes Benz, Stellantis and other European automakers are sharply down from the highs they hit in recent years.

Wind power

Chinese manufacturers of wind turbines have been gaining global market share. In 2024, Chinese companies took six out of the top 10 slots for turbine makers worldwide, according to Bloomberg. Among these, the top four places went to Chinese makers for the first time. European and US manufacturers fell out of the top three, also for the first time.

China’s rise is propelled by a domestic market that installed about 80GW of wind power last year alone, or about 60 per cent of the extra capacity installed globally. But the competitive challenge that leading companies such as Goldwind, Envision and Mingyang present to Western competitors GE, Siemens Energy and Vestas lies mainly in the fact that Chinese-made turbines can be up to 50 per cent cheaper.

Technological disruption is also underway. Dongfang Electric, a Chinese company, also took the mantle for making the world’s most powerful turbine – a 26MW offshore prototype with blades that are 153 meters in length – from Siemens Gamesa earlier this year. This technological breakthrough is likely to further reduce the cost per unit of electricity generated.

How Western corporations can adapt

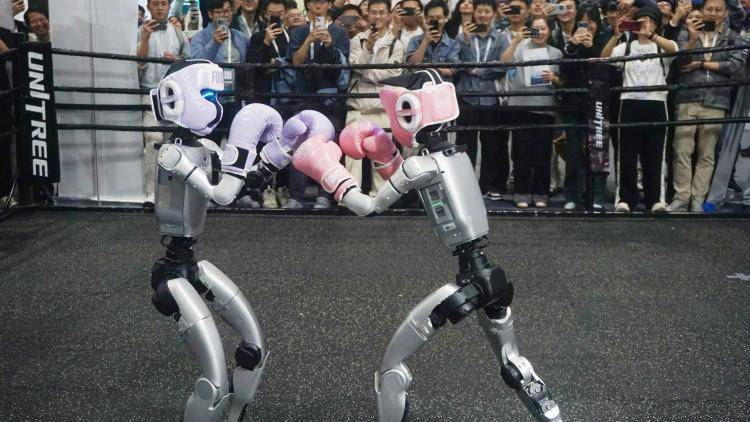

Chinese companies are dominating globally or taking greater market share in a range of other industries, including cellular modules, lithium-ion batteries, 5G telecoms equipment, solar power, nuclear power, factory automation, robotics (including humanoid robots), electrical equipment and more.

Disruptive events are likely to grow more common across all these key sectors. Western corporations therefore need to adopt a series of strategies to self-strengthen and pre-empt disruptive events before they happen.

These strategies may include climbing the technology ladder, including by investing heavily in R&D inside China as, for example, Germany’s VW and Mercedes Benz have done.

Western corporations may also consider restructuring to cut costs, so they are better able to compete with Chinese price-setters, as well as strategic alliances to create efficiencies and boost brands.

Subscribe to our weekly newsletter

Our flagship email provides a round-up of content, plus the latest on events and how to connect with the institute.

Article second half

Corporations will also want to lobby governments in the West to lead meaningful industrial policy programmes. From their side, Western governments must first step up education for their civil servants, corporate executives and others on China’s multi-faceted emergence as the world’s leading tech power.

They should then seek to foster self-strengthening policies both at the corporate level and in terms of state-led industrial policy to drive innovation and technological upgrading.

So far, Washington has put more than 1,000 Chinese companies on its so-called ‘entity list’, which restricts exports of US technology to specific companies. It has also raised tariffs on Chinese imports and instituted aspects of industrial policy such as the Chips and Science Act, which aim to fund companies to develop more robust technology businesses.

The EU has been less overt, raising tariffs on a few selected products and taking other administrative measures to ‘de-risk’ from China. Europe may need to pursue a more active strategic industrial policy or risk major European corporations falling yet further behind their Chinese counterparts.

You must be logged in to post a comment.