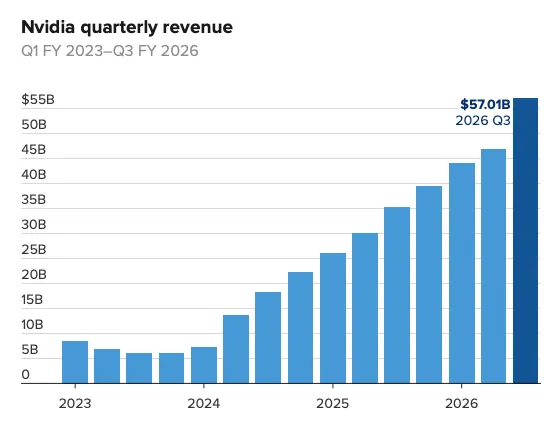

Nvidia’s quarterly results dispel talk of an AI bubble

Nvidia posts $57bn Q3 revenue and $32bn net profit, easing fears of an AI bubble.

Nvidia’s third-quarter revenue came in at $57bn, up 62% from a year earlier. Net profit reached $32bn, an increase of 65%, according to the company’s financial statements.

On both measures, the most valuable company in the world beat Wall Street’s expectations.

Data-centre revenue reached $51.2bn. The rest came from gaming, visualisation and automotive.

Nvidia’s quarterly revenue growth. Source: CNBC.

The firm’s CFO, Colette Kress, said projects to build AI factories will require roughly 5m graphics processors in total.

“This demand spans all markets, sovereign states, modern enterprises and supercomputing centres,” she added.

The Blackwell Ultra GPU unveiled in March is in especially high demand. Previous generations are also sought after. CEO Jensen Huang said sales “exceed all expectations”.

“Demand for compute continues to grow in training and inference — each is increasing exponentially. We have entered a spiral of success. The ecosystem is expanding rapidly — more and more new foundation-model developers and AI startups are appearing across industries and countries. The technology is permeating everywhere, doing everything at once,” he said.

Nvidia guided for revenue to rise further, to $65bn in the fourth quarter.

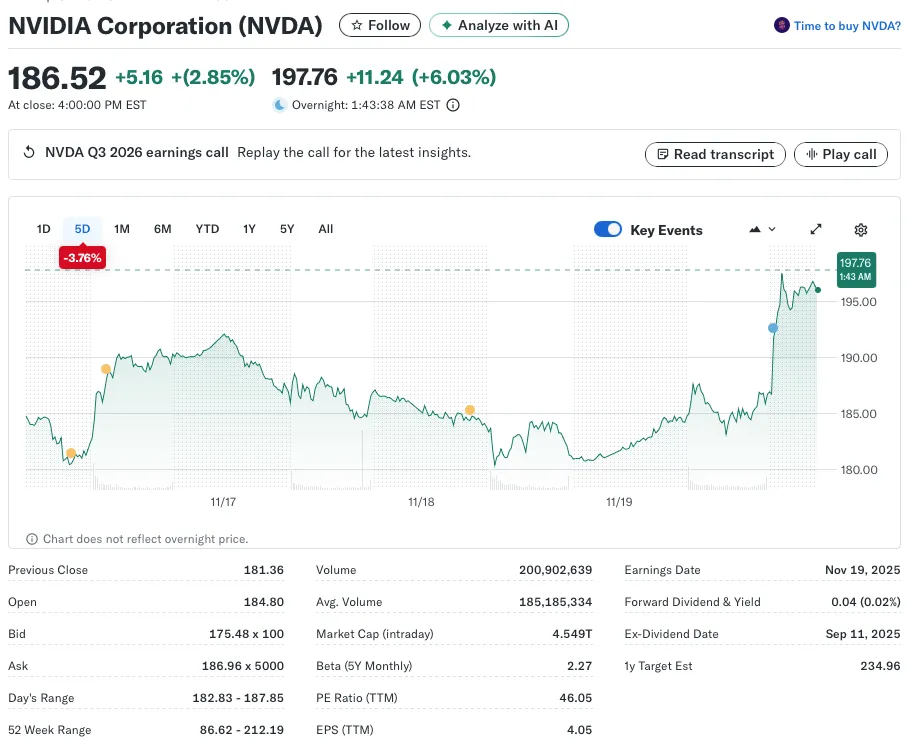

Market reaction

In recent months the narrative has strengthened that an AI bubble is forming. Before the report was released, shares of AI-linked firms had fallen sharply:

- CoreWeave -44%;

- Oracle -14%;

- Palantir -17%.

Investors feared that weak results from the American chipmaker would point to a potential bubble burst and trigger further declines.

A strong print from a company with a market value above $4.5trn and around an 8% weight in the S&P 500 lifted Nvidia and other technology stocks.

Nvidia shares rose 6% in after-hours trading. Source: Yahoo Finance.

The S&P 500, which includes the 500 largest US companies, rose 1.31%.

S&P 500 performance. Source: Yahoo Finance.

Crypto investors also feared another leg lower in digital-asset prices amid weakening risk appetite. But after the strong report, bitcoin recovered above $90,000.

Hourly BTC/USD chart on Binance. Source: TradingView.

Cipher Mining jumped more than 10% in after-hours trading. IREN, Bitfarms, TeraWulf and CleanSpark followed. MARA gained 4%.

Cipher Mining shares. Source: Yahoo Finance.

In recent years demand for data-centre capacity has surged alongside the rise of artificial intelligence. As a result, many miners have pivoted to servicing AI infrastructure.

In September 2024, analysts at Bernstein noted that shares of bitcoin miners that are simultaneously building AI businesses are outperforming those focused solely on crypto mining.

Asian semiconductor stocks also rose after Nvidia’s report. South Korea’s SK Hynix added 2%; the company is one of the US chipmaker’s key suppliers of high-speed memory.

Samsung climbed by more than 5%, and TSMC by 4%.

Not a bubble

Nvidia’s CEO offered three reasons why the AI industry is not a bubble ready to burst.

First, areas such as data processing, ad recommendations and search are shifting to GPUs because they need artificial intelligence. That means traditional CPU-based infrastructure will gradually migrate to Nvidia’s products.

Second, AI technologies are not only embedded into existing applications but also enable the creation of new products.

Third, the development of agentic artificial intelligence capable of reasoning and planning will increase demand for computing resources.

“There is a lot of talk about an AI bubble. We see something quite different,” Huang concluded.

In October he said that Nvidia has orders for Blackwell and Rubin chips worth $500bn. Deliveries are scheduled five quarters ahead.

Partnership with Musk

Huang and Elon Musk took part in a US–Saudi investment forum in Washington, DC. At the event they said that the AI startup xAI will be the first customer of a new large data centre in Saudi Arabia now under construction. The facility will be equipped with hundreds of thousands of Nvidia chips.

The partnership between the American chipmaker and Humain emerged in May. Under the agreement, the sides plan to create a network of data centres with total capacity of 500MW in Saudi Arabia.

Humain was founded in early 2025 and is owned by a state investment fund.

“Can you imagine that a startup with revenue of about $0bn is going to build a data center for Elon,” Huang said.

In November, the government of Ukraine launched a joint initiative with Nvidia to build a sovereign artificial intelligence.

You must be logged in to post a comment.